- The Data Room

- Posts

- The Data Room #7

The Data Room #7

Venture Intelligence for Investors & Startups

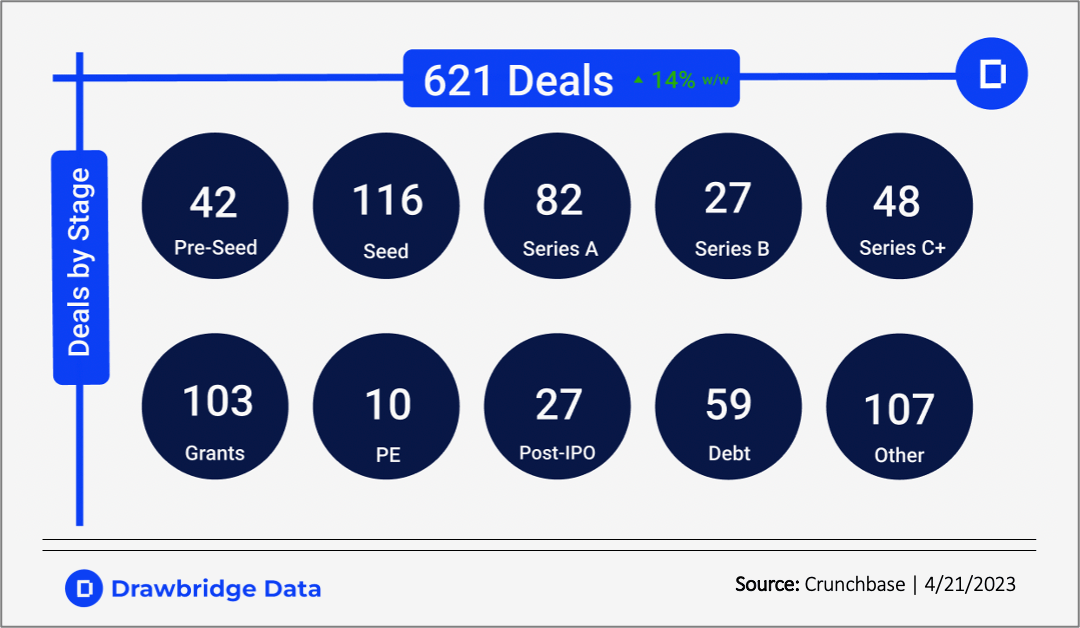

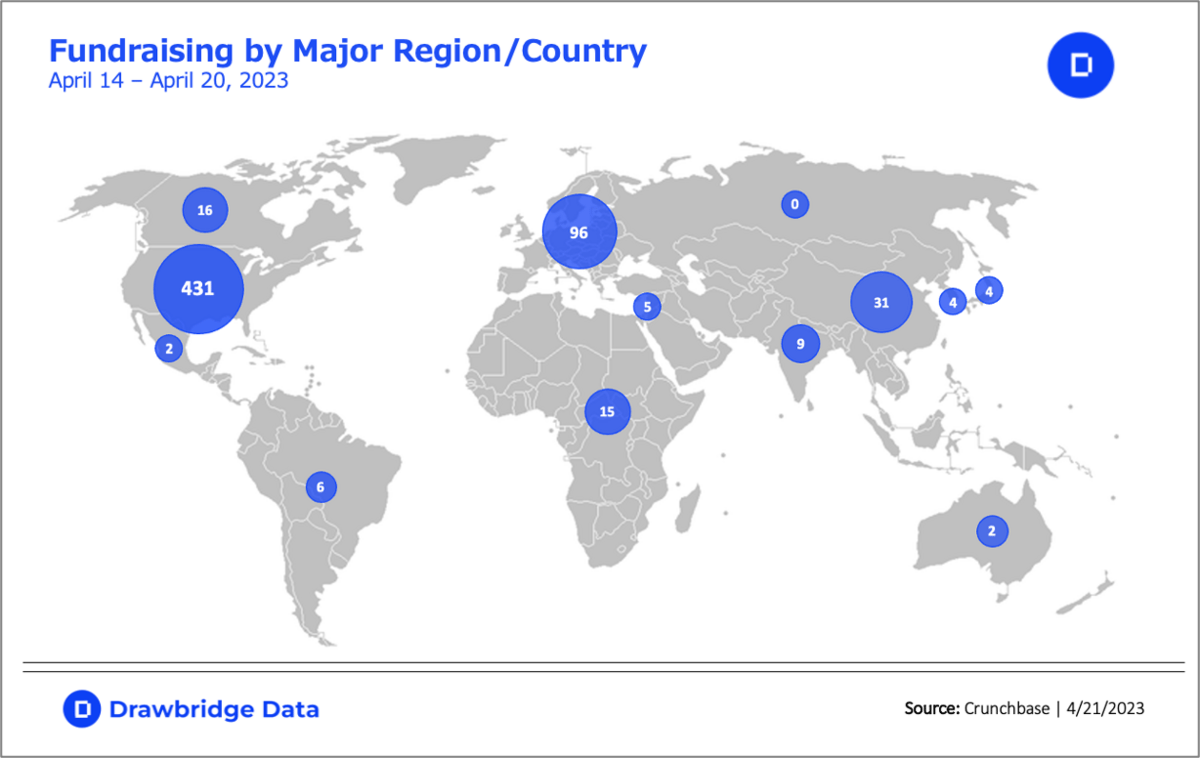

Weekly Fundraising Overview

< Sector specific weekly fundraising overview // 4.14 - 4.20 >

The Mad Dash

< Curated charts that filter the noise to tell the real story / >

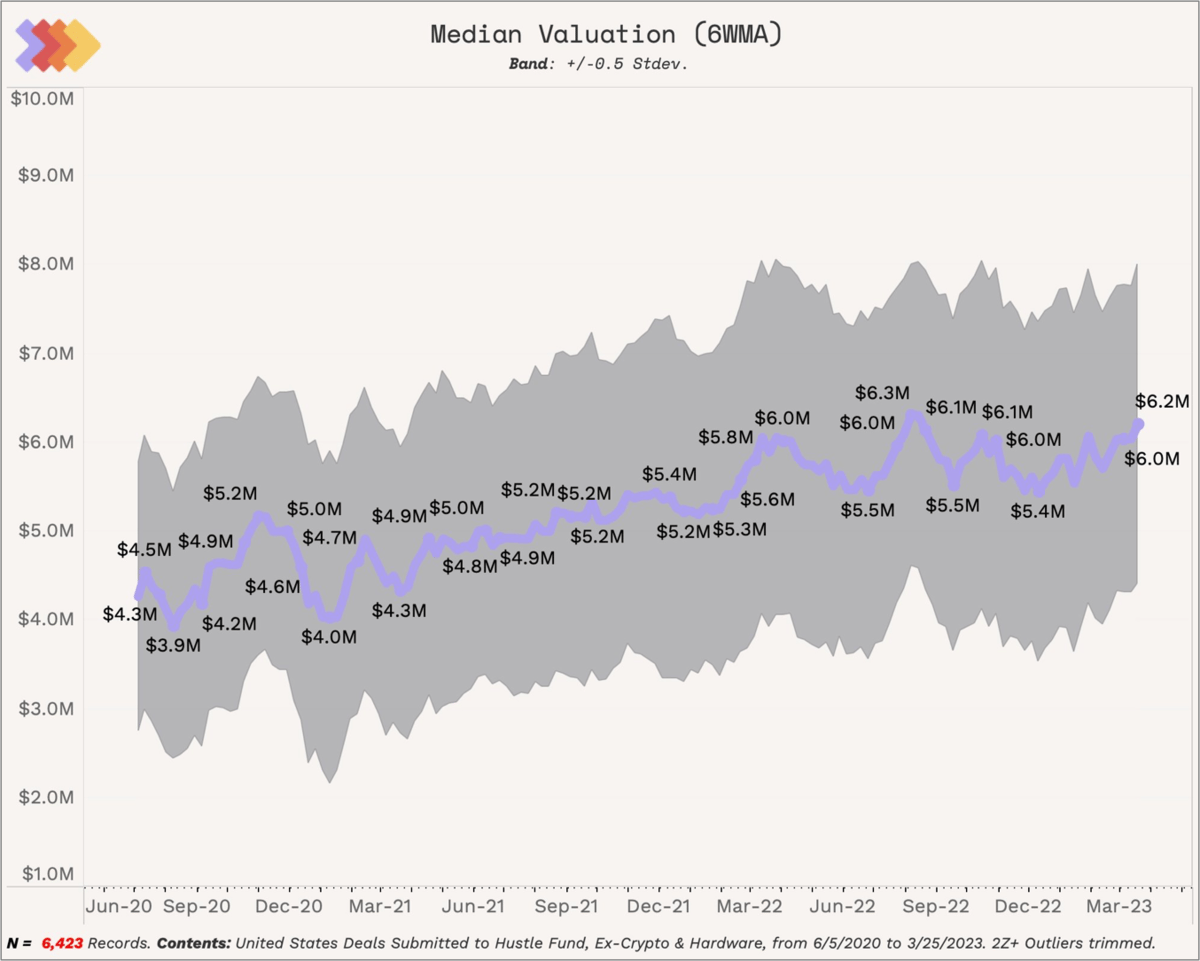

Source: @will_bricker on Twitter

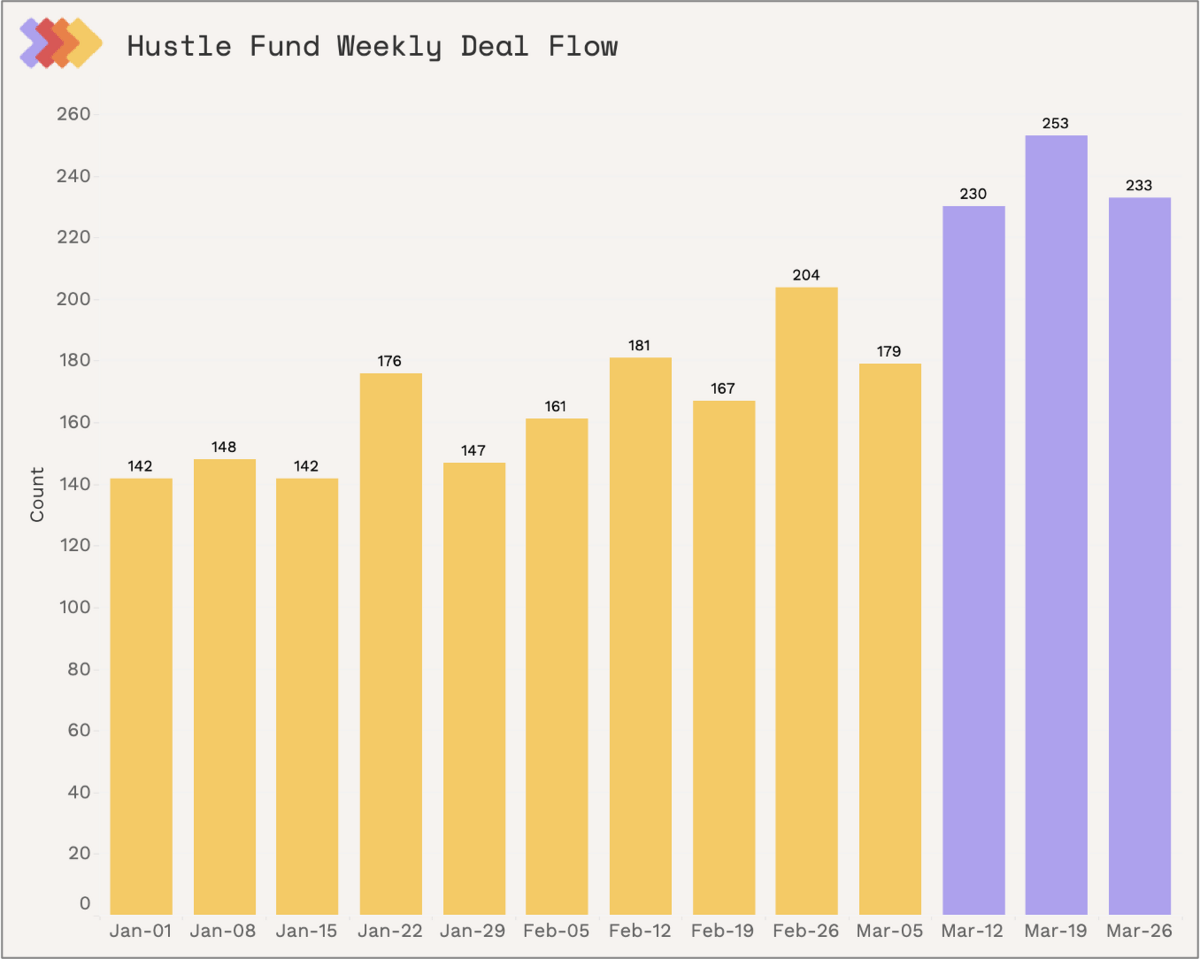

Weekly deal flow into Hustle Fund (an early stage generalist pre-seed and seed fund) shows an interesting increase in volume despite the SVB collapse in early March.

Source: @will_bricker on Twitter

Overall valuations have seen a general rebound vs 4Q22 , with median pre-seed valuations holding firmly above $6M USD.

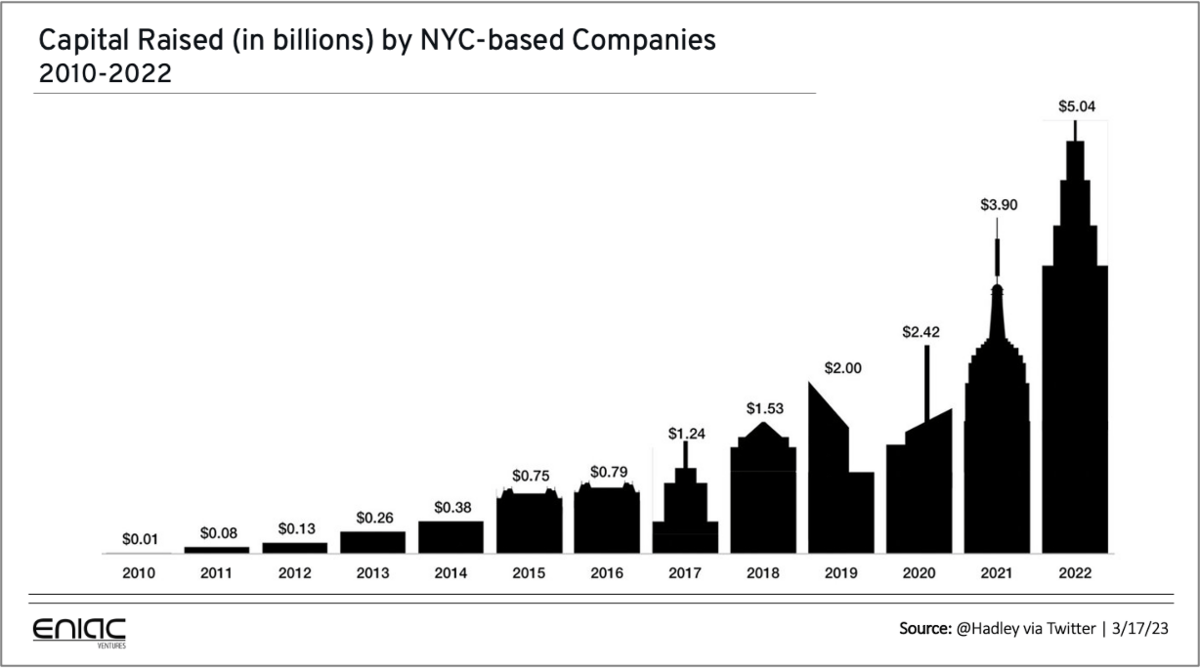

NYC-based companies continue to see tremendous amounts of fundraising flow into the ecosystem. It’s shocking to see how far it has come over the last decade with tech slingshotting out of the last recession.

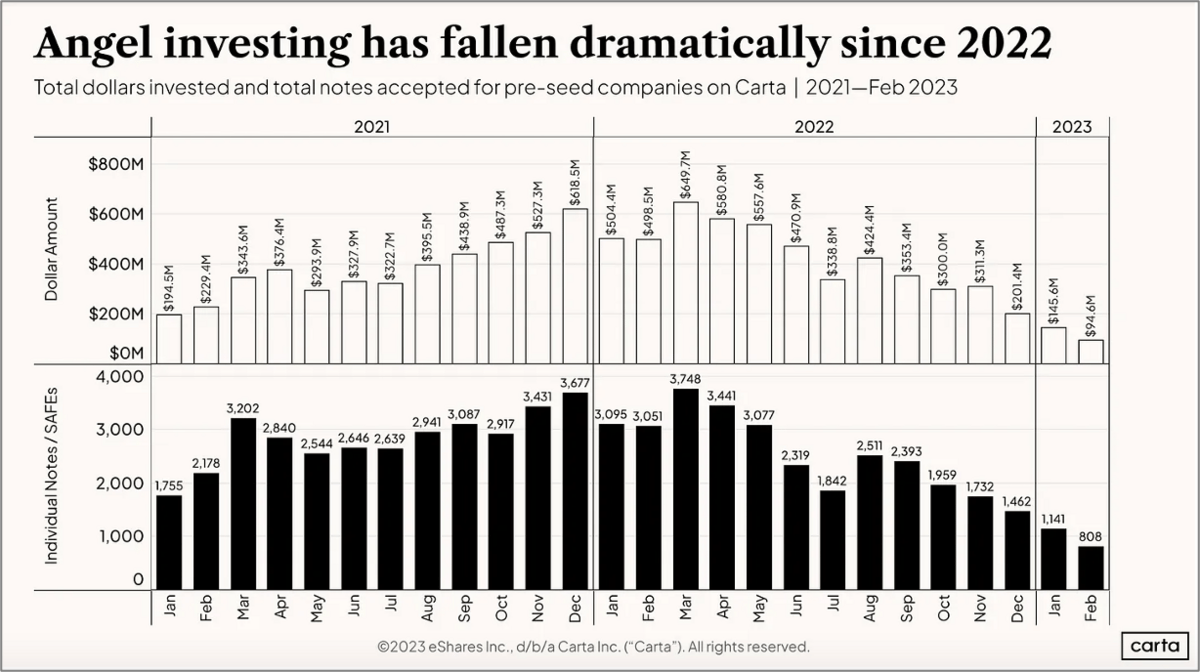

Angel investing into pre-seed companies remains in a m/m decline after peaking in March 2022.

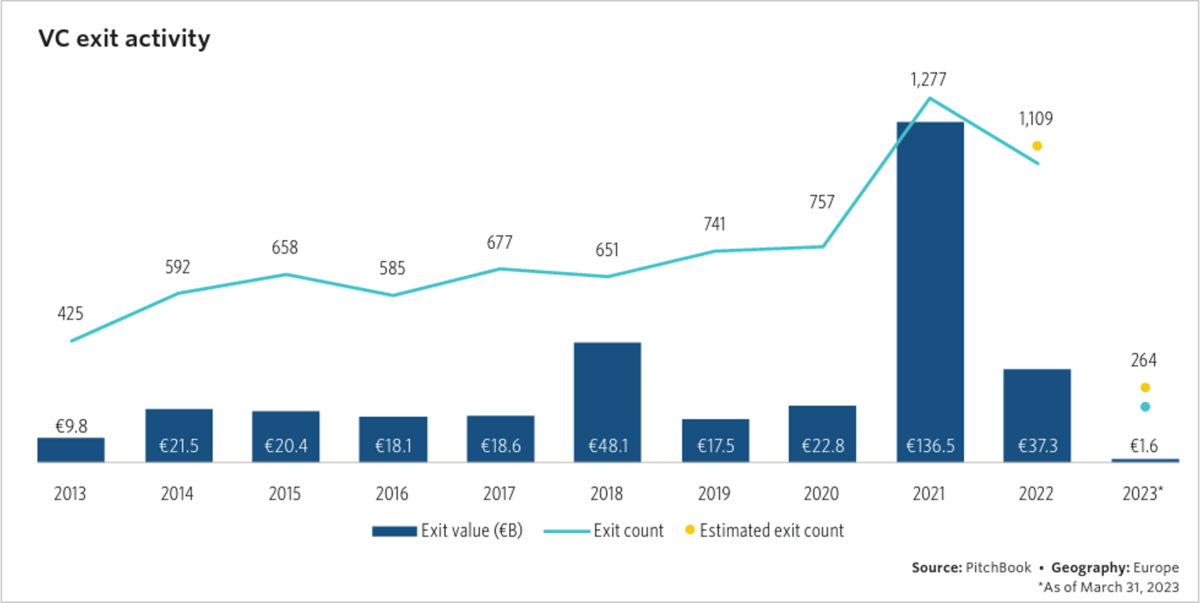

VC exits “effectively ceased in Q1 as unfavorable macroeconomic conditions and weaker valuations dampened exit appetite. Instead of seeking near-term liquidity, GPs and founders will be looking to manage runways as funding becomes harder in 2023”, via Pitchbook.

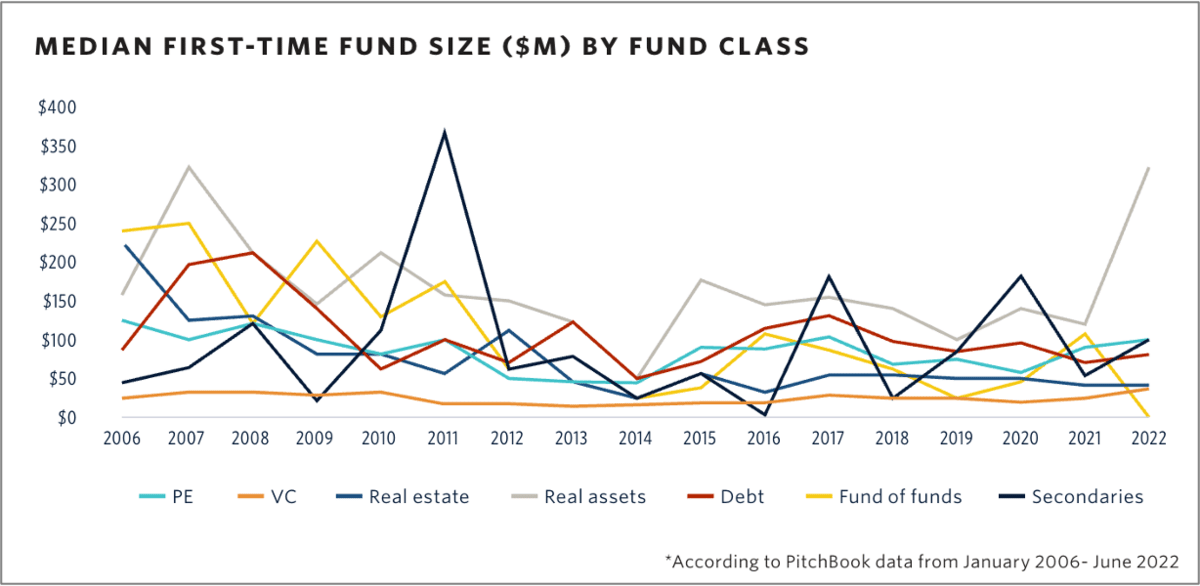

Median first-time fund size saw a jump from ~$50m in 2020 to nearly $100m in 2022. Meanwhile, first-time Real Asset fund sizes went parabolic in line with broader macro uncertainty similar to 2007.

Must Reads of the Week

< Top reads from the week in fundraising, startups and venture capital / >

[Pragmatic Engineer] The State of Startup Funding in 2023

[Forbes] 20 VCs Capture 95% Of VC Profits: Implications For Entrepreneurs & Venture Ecosystems

[Axios] Scoop: Schumer lays groundwork for Congress to regulate AI

[Bloomberg] India is Taking on China in the $447 Billion Space Economy

[TechCrunch] Who captures the most value after the SaaS-acre? Enterprises or startups?

[Visual Capitalist] The World’s Biggest Startups: Top Unicorns of 2021

Cant Miss Tweets

< Must See tweets from VCs, Angels and Builders / >

It's time for pre-seed startup valuations for Q1 2023. Thousands of startups applied to @HustleFundVC this quarter, and we want to share it with all of you.

1/11

— will bricker (@will_bricker)

10:22 PM • Apr 18, 2023

10 Notion tips that'll 10X your productivity:

— Easlo (@heyeaslo)

2:00 AM • Apr 18, 2023

Spotted: AI in the wild 🐆

Re-sharing some of the coolest ways we’ve seen our community use Notion AI. Hope this inspires you (like it’s inspired us)!

— Notion (@NotionHQ)

8:45 PM • Apr 19, 2023

ChatGPT is just the tip of the iceberg.

But don't limit yourself to just ChatGPT.

Here are 15 Insanely useful AI tools for you to save hours (instant bookmark):— Hasan Toor ✪ (@hasantoxr)

1:58 PM • Apr 17, 2023

One of the hardest parts of being an investor is having the patience to do nothing.

In the search for activity that might not be there, the quality of decisions will reduce.

Be patient. This can be a game of who survives the longest.

— Harry Stebbings (@HarryStebbings)

12:21 AM • Apr 18, 2023

Fundraising Journey Q&A

< Sharing insights & takeaways from the fundraising process / >

Reply to this email or reach out to [email protected] if you or a founder you know would like to be spotlighted in our weekly 1-on-1 founder Q&A - sharing insights from their fundraising journey (free marketing 😁)

Sign up for Beta Access

Sign up for the Drawbridge Data Beta Database today 👇

(now say it 5 times fast!)