- The Data Room

- Posts

- The Data Room #6

The Data Room #6

Venture Intelligence for Investors & Startups

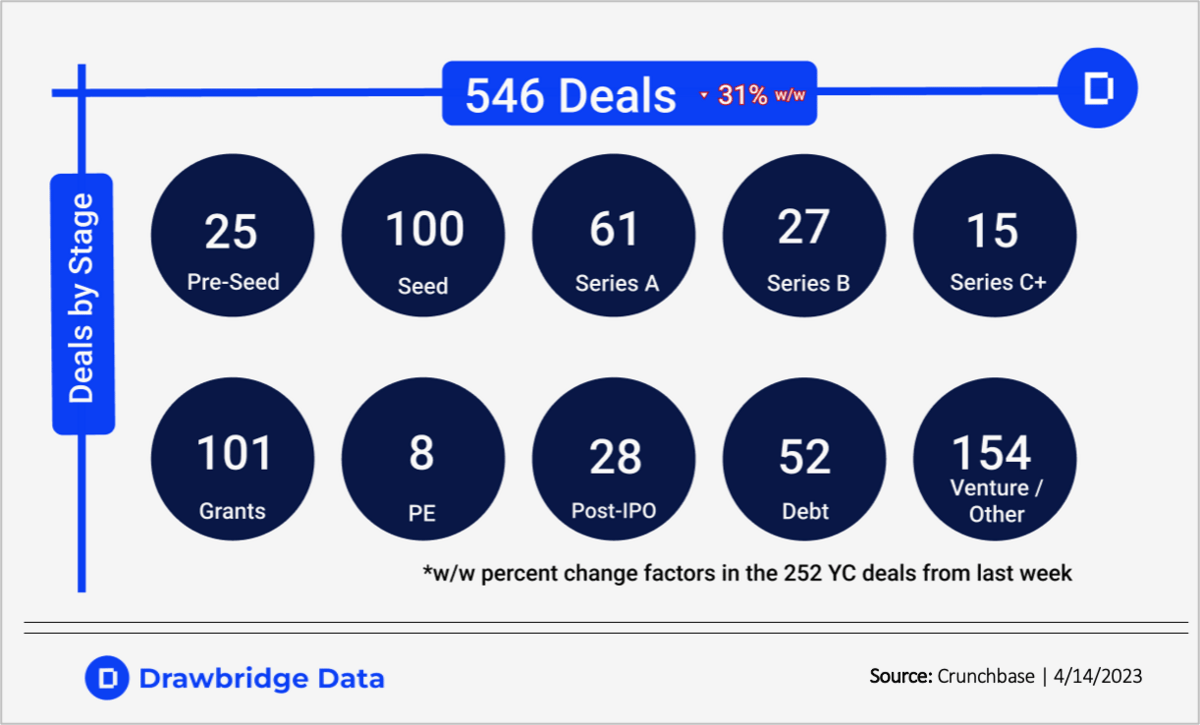

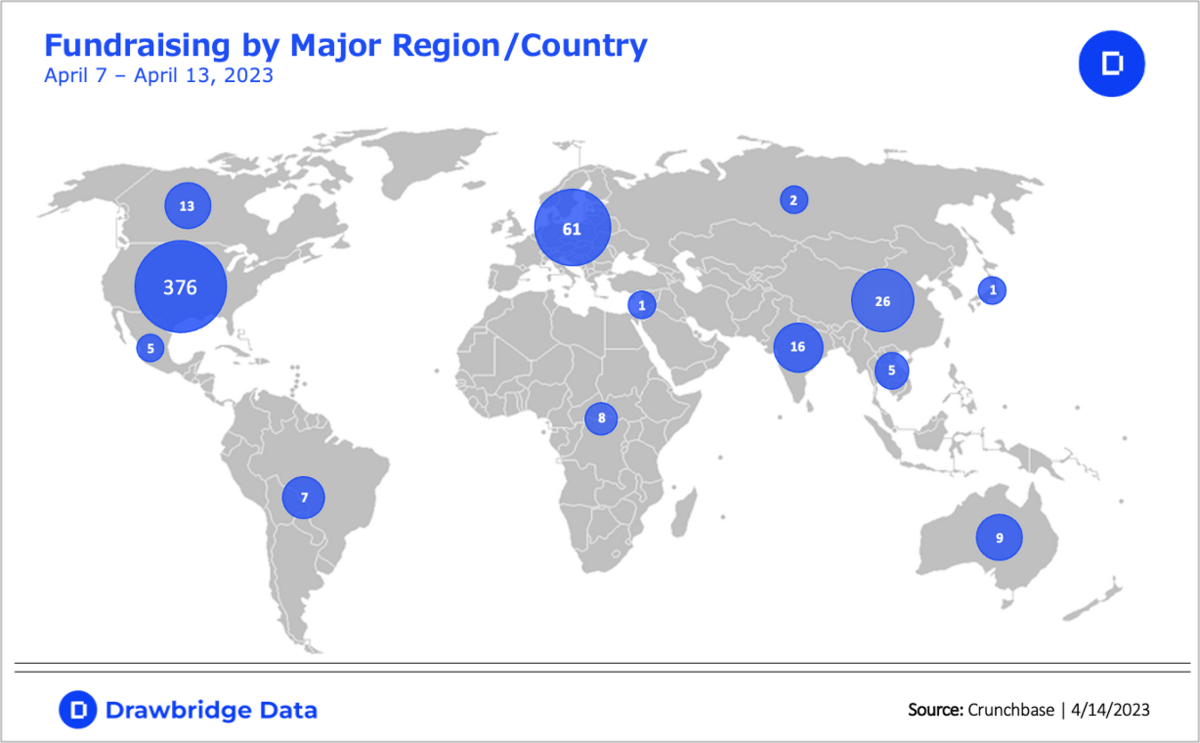

Weekly Fundraising Overview

< Sector specific weekly fundraising overview // 4.07 - 4.13 >

The Mad Dash

< Curated charts that filter the noise to tell the real story / >

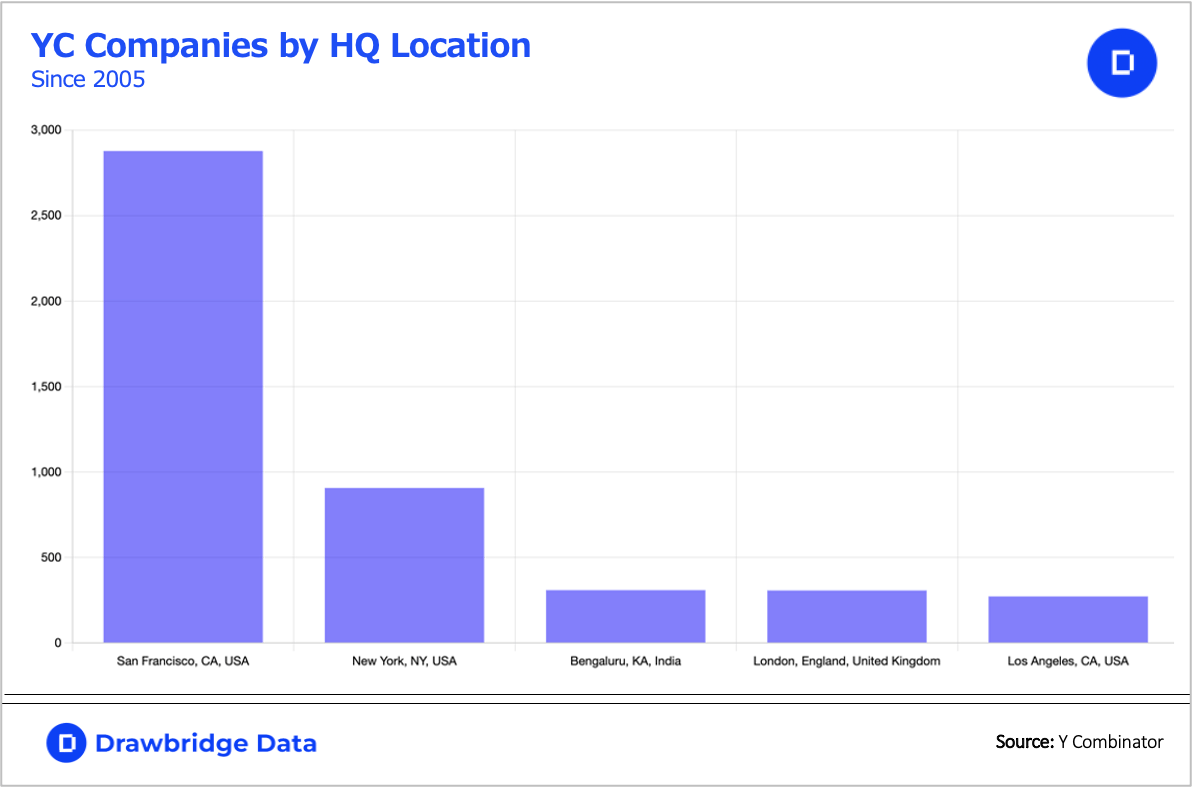

The vast majority of YC companies are based in the Bay Area, with this trend beginning to change since COVID allowed for remote participation in the incubator. Surprisingly, Bengaluru, India sits in the Top 3 — above traditional key markets like London and Los Angeles in YC funding.

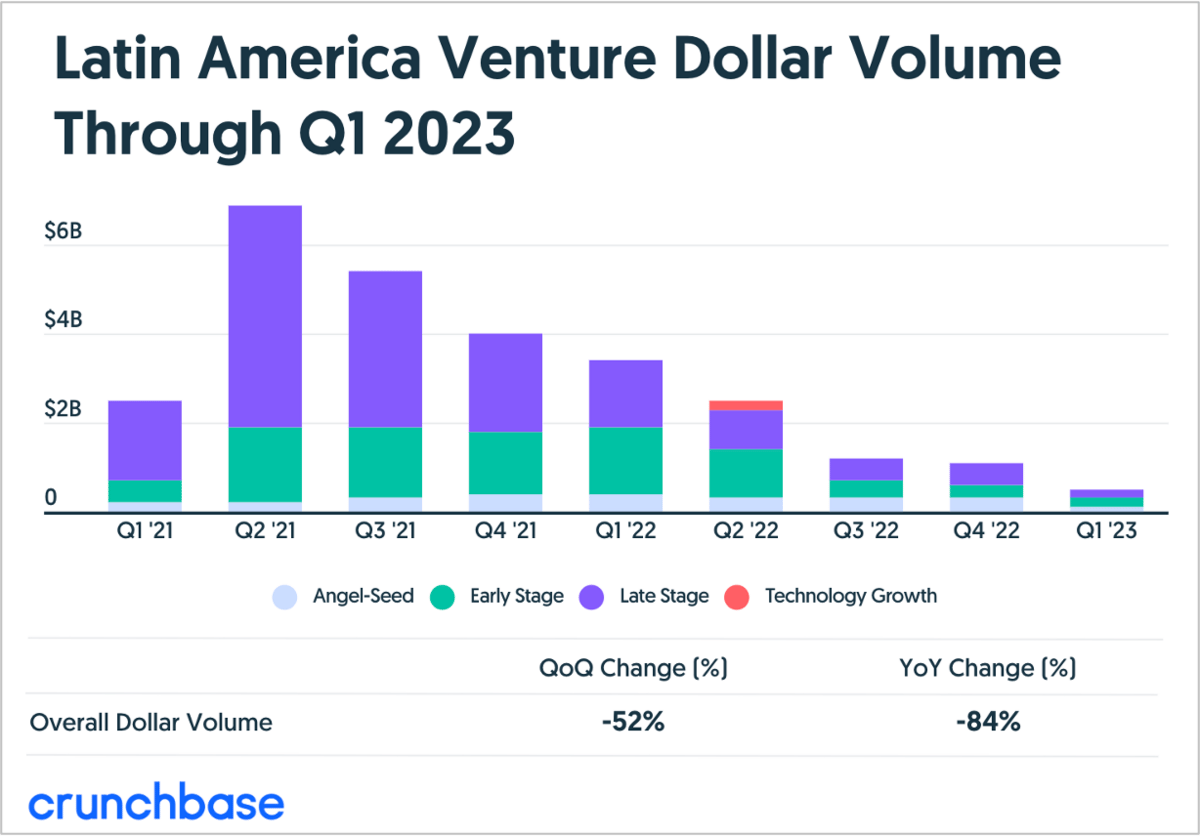

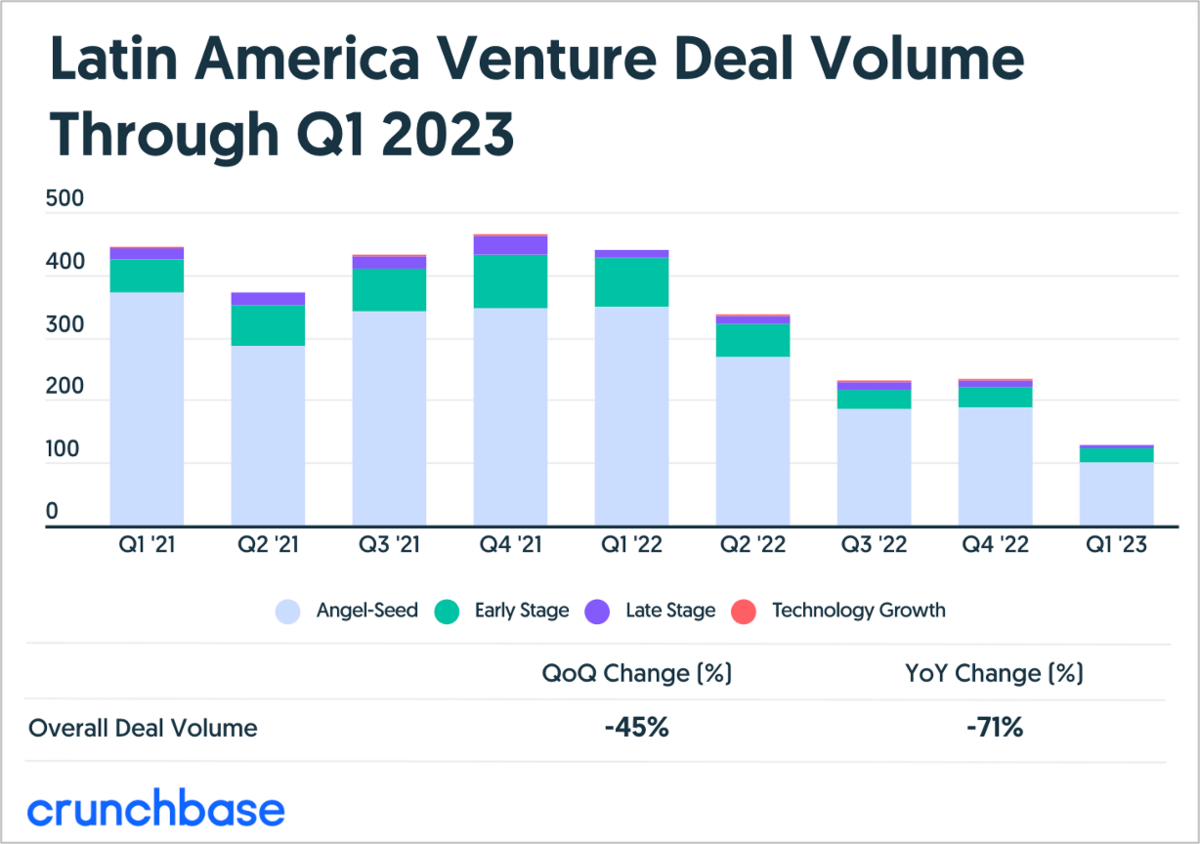

LatAm venture funding in both dollar and deal volume has not been spared by the broader market cooldown, according to data from Crunchbase.

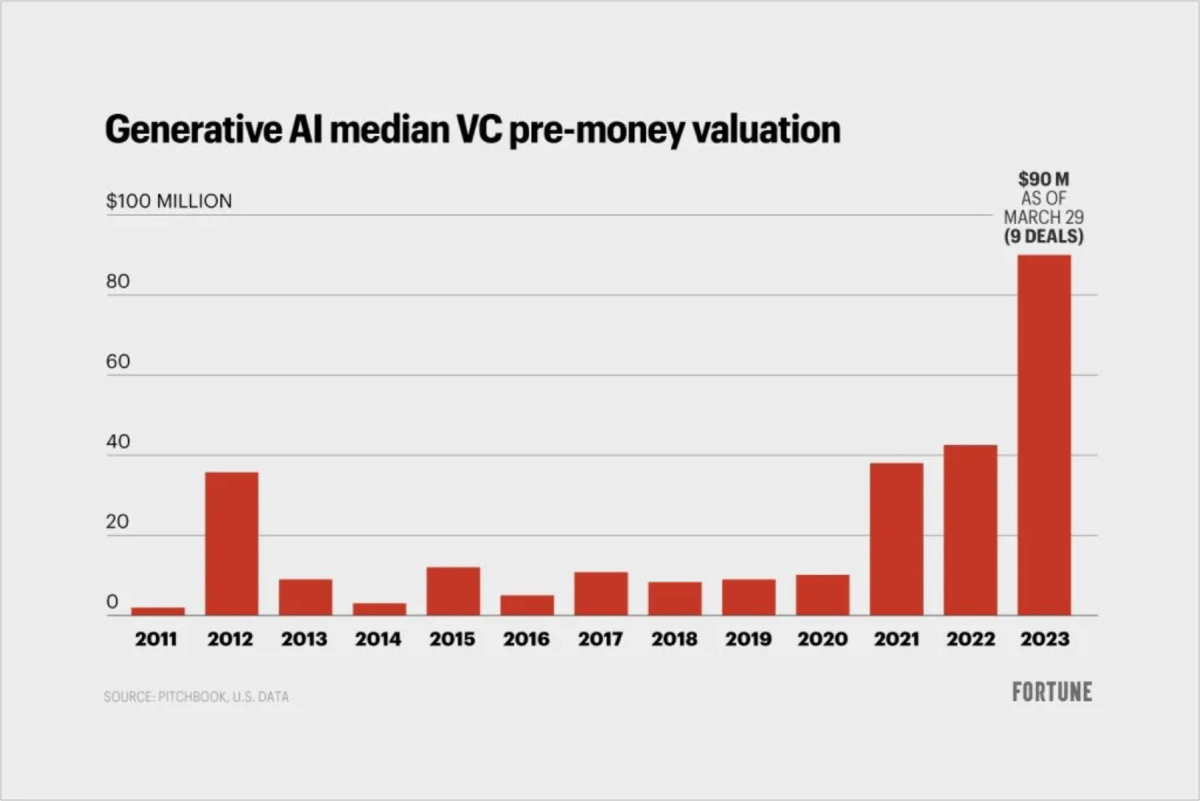

Generative AI companies have hit peak froth with medium VC pre-money valuations approaching $100M. Many expect this to go through a correction as investors begin to question enduring moats in a hyper competitive arena.

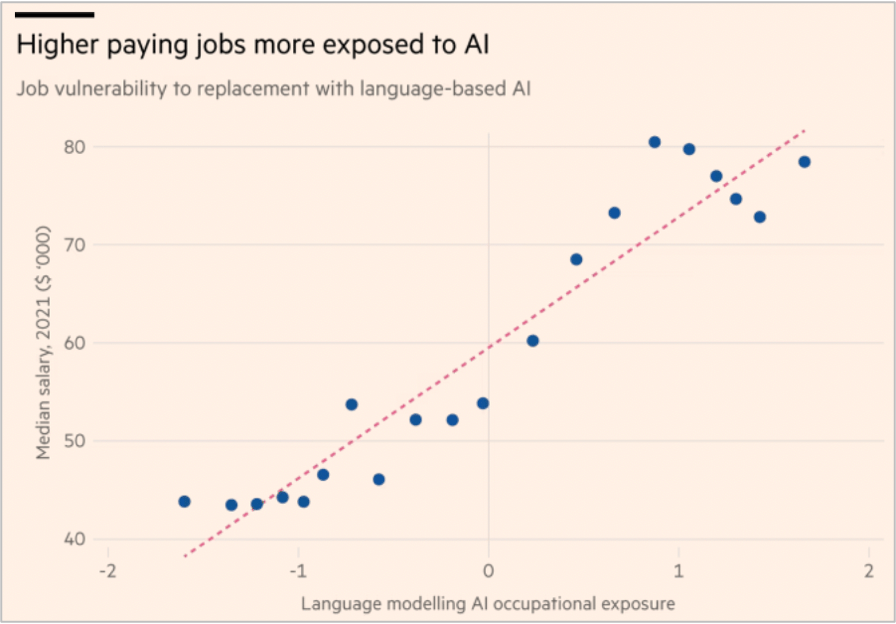

Source: Financial Times

Analysis from the Financial Times indicates higher paying jobs appear to be most vulnerable to replacement with language-based AI.

Must Reads of the Week

< Top reads from the week in fundraising, startups and venture capital / >

[TechCrunch] Hey look, unicorns are rare again!

[Bloomberg] The Pandemic Didn’t Upend US Geography

[Economic Times] Late-stage deals plummet to 21-quarter low in US as VC funding halts: report

[TechCrunch] Yeah, the data is bad, but I’m still optimistic about emerging managers

[Jason Lemkin Blog] The Average SaaS Leader Grows 53% … At $1 Billion in ARR

[Watcher Guru] US Dollar has Lost 98% of its Purchasing Power Since 1971

[Entrepreneur] Twitter Just Got a Major New Feature — and Is One Step Closer to Becoming Elon Musk's 'Super App'

Cant Miss Tweets

< Must See tweets from VCs, Angels and Builders / >

I invest in software companies that intend to reduce friction at scale. Here are four questions I ask every CEO.

— Martin Tobias (Pre-Seed VC) (@MartinGTobias)

8:51 PM • May 5, 2022

📊VC fund managers: let me validate you. It’s not just you. It is hard to raise funds in this market. This year, funds are on track to raise 73% less capital than in 2022. h/t @PitchBook

— Lolita Taub (@lolitataub)

4:45 PM • Apr 12, 2023

What's the difference between Venture Capital and Private Equity?

A lot...

Read on:

— CJ Gustafson (@cjgustafson222)

12:15 PM • Apr 7, 2023

How are VC funds benchmarked against each other?

There’s something called “vintage year,” which is the yr the first check was written into a startup from that fund.

Performance is benchmarked against funds who also deployed their first check that yr.

The interesting thing…👇🏼

— Nicole DeTommaso 🪄 (@nic_detommaso)

2:52 PM • Apr 13, 2023

Fundraising Journey Q&A

< Sharing insights & takeaways from the fundraising process / >

Reply to this email or reach out to [email protected] if you or a founder you know would like to be spotlighted in our weekly 1-on-1 founder Q&A - sharing insights from their fundraising journey (free marketing 😁)

Sign up for Beta Access

Sign up for the Drawbridge Data Beta Database today 👇

(now say it 5 times fast!)