- The Data Room

- Posts

- The Data Room #5

The Data Room #5

Venture Intelligence for Investors & Startups

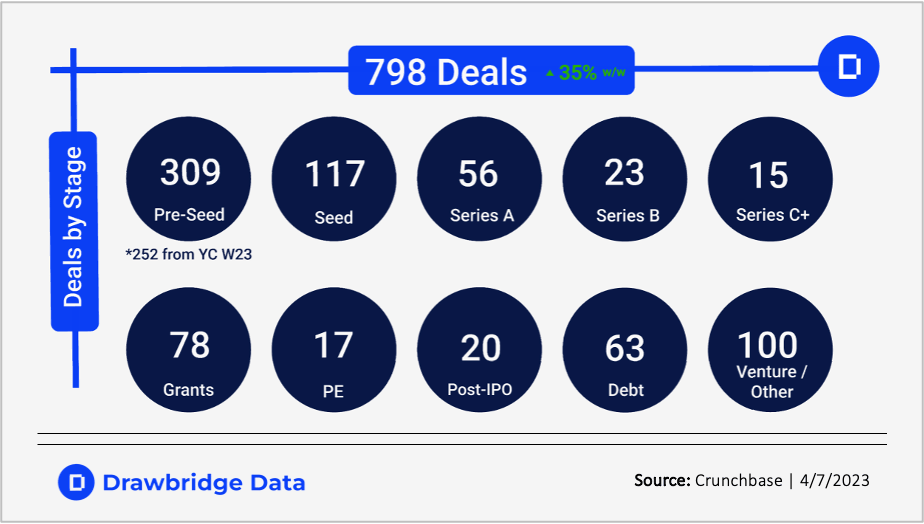

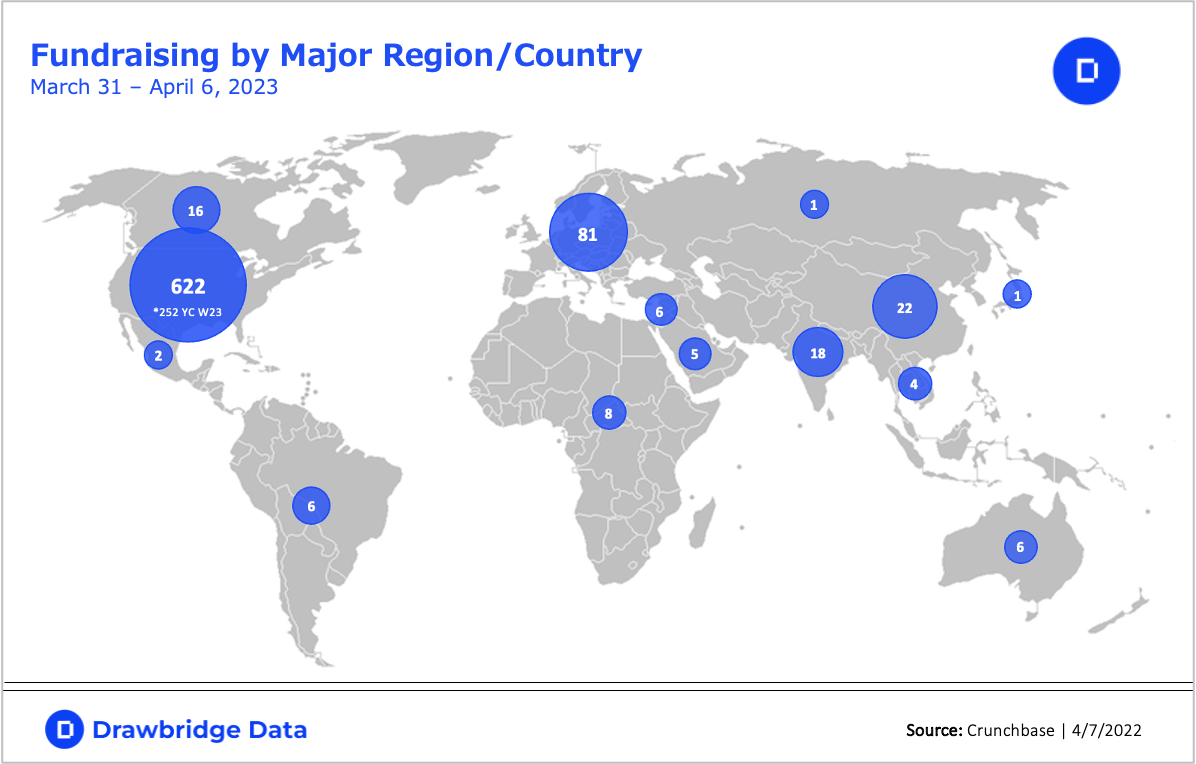

Weekly Fundraising Overview

< Sector specific weekly fundraising overview // 3.31 - 4.06 >

The Mad Dash

< Curated charts that filter the noise to tell the real story / >

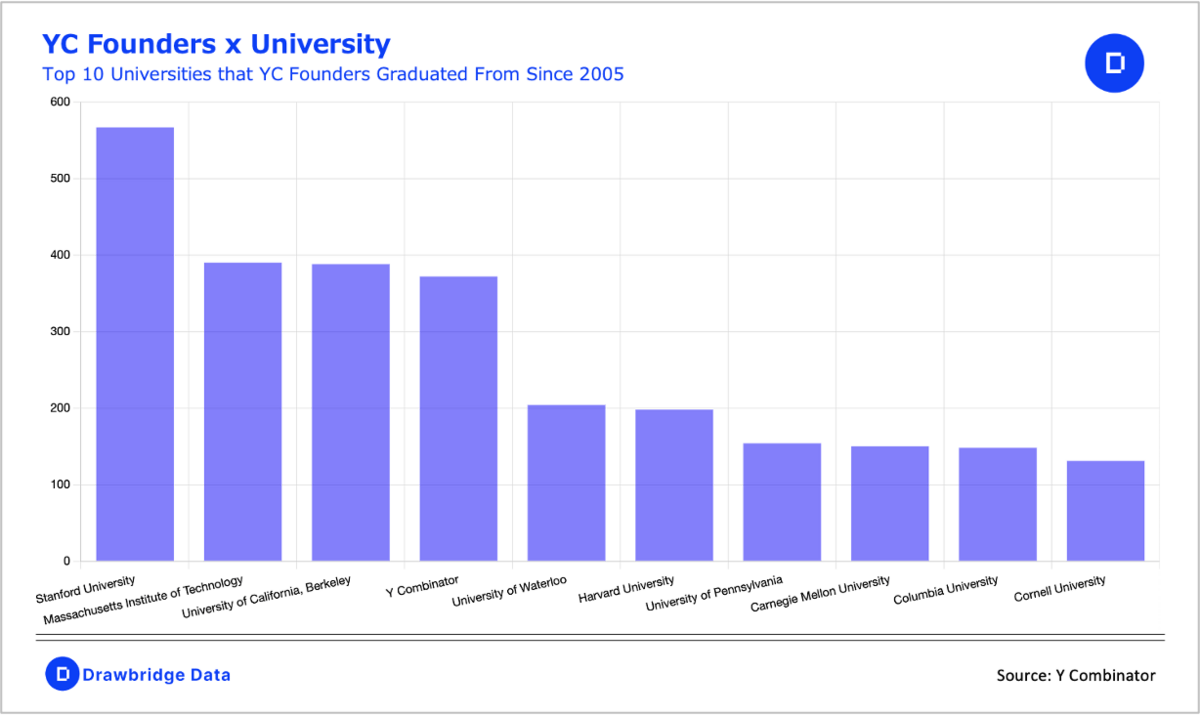

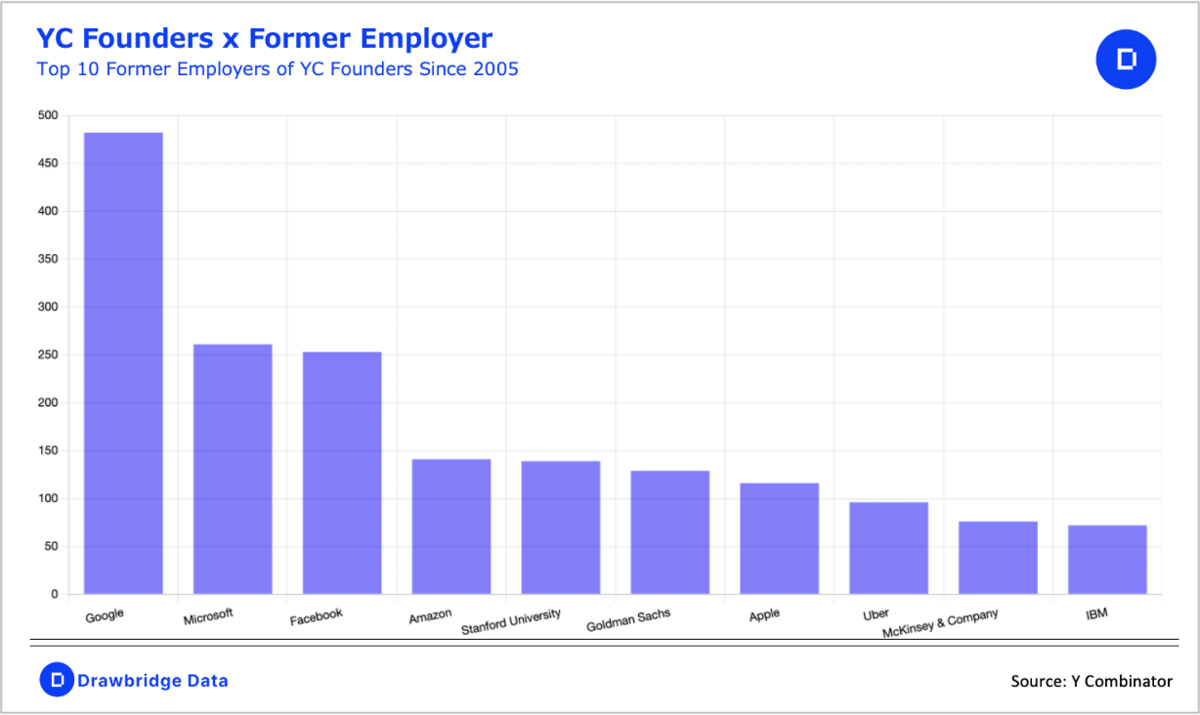

With YC Demo Day underway and new S23 applications due today, we take a closer look at who Y Combinator invest in. We discovered a heavy preference on credentials form top schools and the big tech giants that we all know. Nothing surprising here.

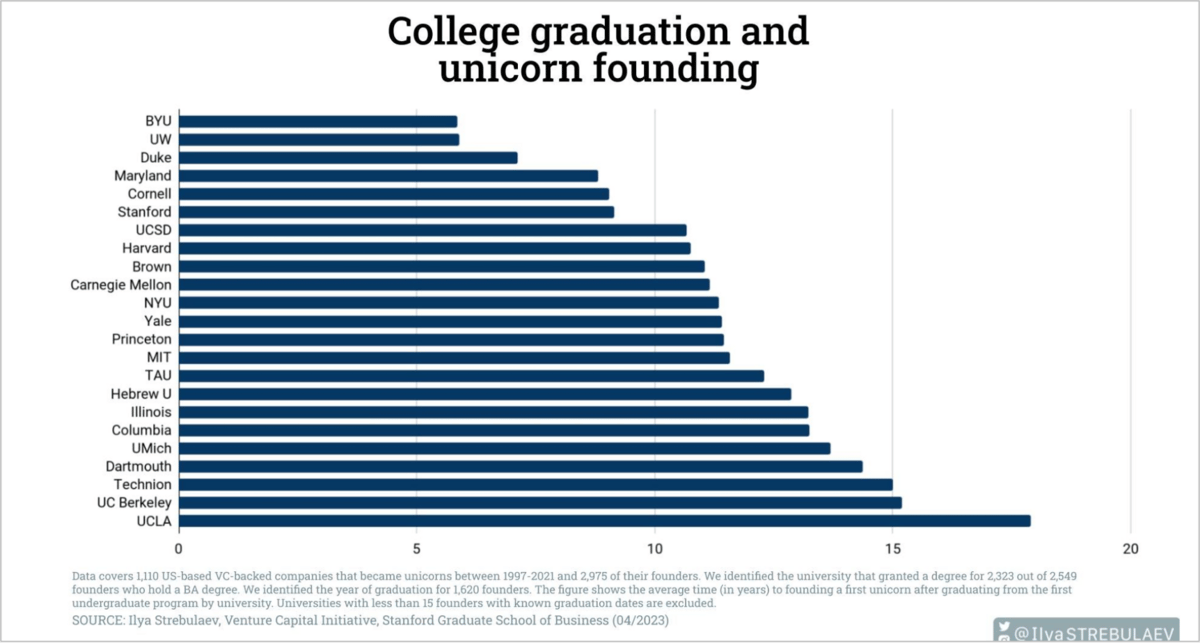

Meanwhile, data for looking into the most unicorn founders by college shows a more diverse story with a mix of top schools along with some underrepresented universities in tech such as BYU, Wisconsin, Maryland, and Michigan. Two Israeli-based universities, Technion - Israel Institute of Technology and Hebrew University break the top 10, despite a 50% fall in Israeli-based tech startups in 2022 [1] and accounting for only around 10% of global yearly VC investments [2].

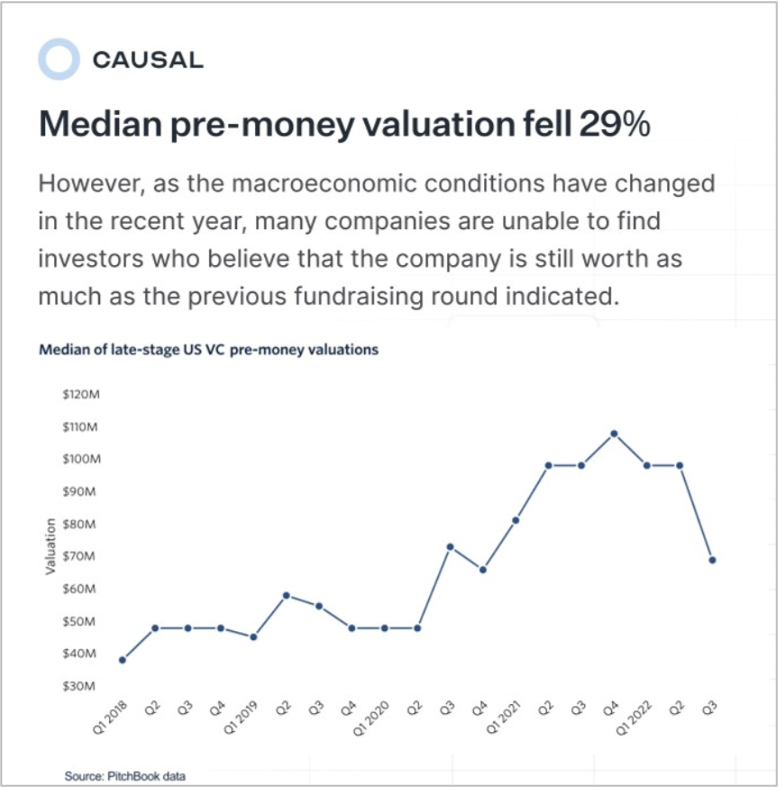

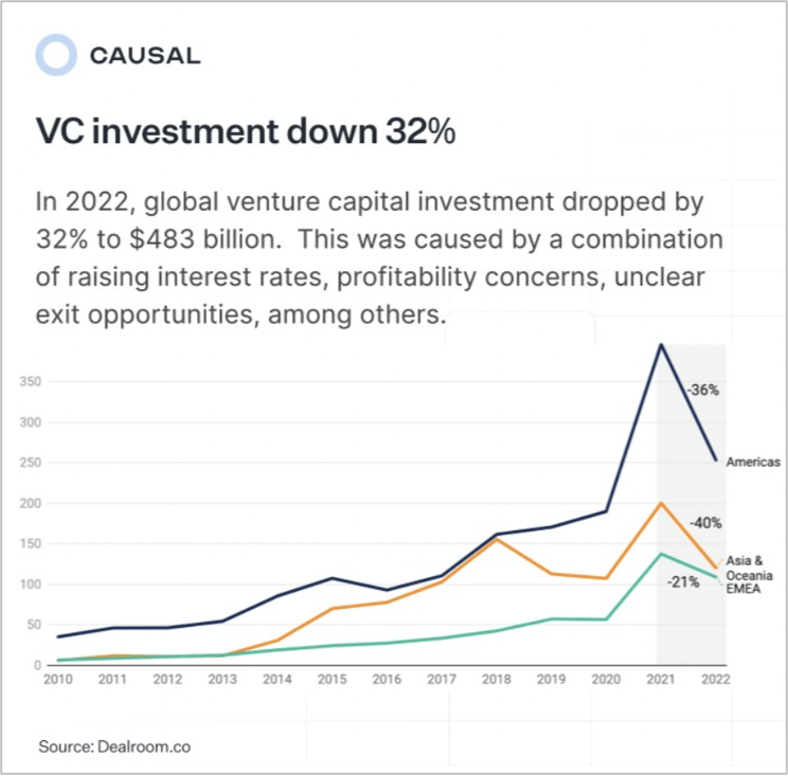

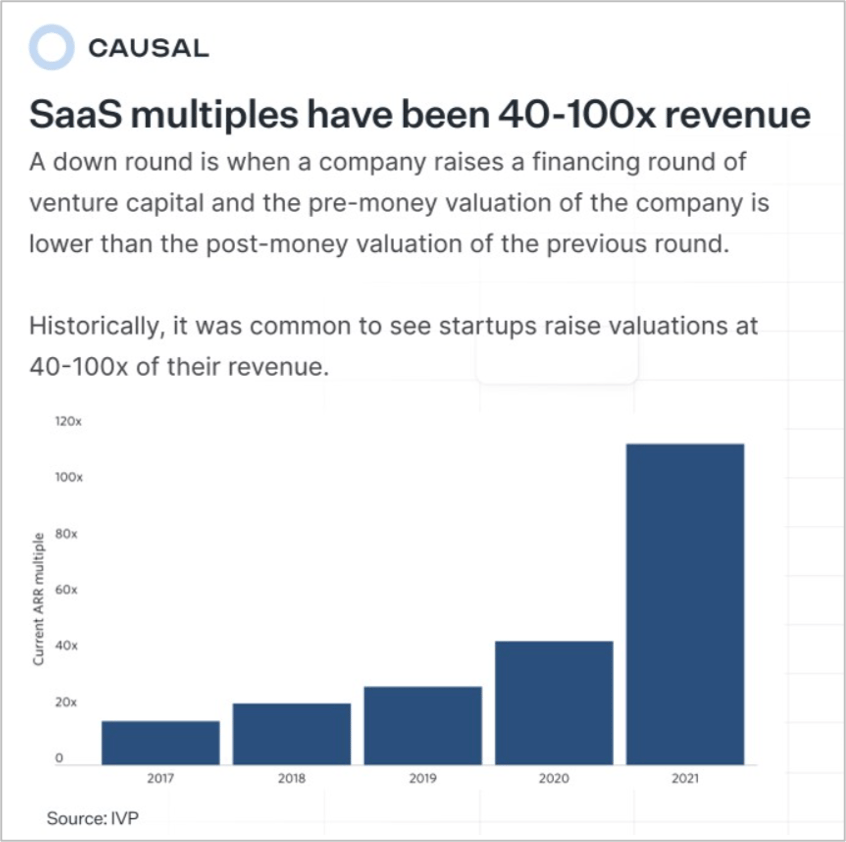

Data consolidated by Casual highlights the VC reset that began in early 2022 which only continues into 2023. Many top funds continue to raise and deploy capital despite uncertain macro conditions, while newer funds from the 2021 vintage might have deployed their capital too quickly at unsustainable valuations and are struggling to raise a new fund as easily from LPs.

Must Reads of the Week

< Top reads from the week in fundraising, startups and venture capital / >

[TechCrunch] Investors unfazed by Q1 crypto funding decline

[Bloomberg] US Hiring Moderates, Unemployment Falls in Mixed Signal for Fed

[Visual Capitalist] Ranked: The U.S. Banks With the Most Uninsured Deposits

[Signature Block] How to Get Deal Flow

[Fortune] Bay mourns Bob Lee after tech exec's stabbing death

[CNBC] The IRS released its $80 billion funding plan. Here’s what it means for taxpayers

[TechCrunch] In a slowing market, venture investor Canaan still closes $850M across two new funds

Cant Miss Tweets

< Must See tweets from VCs, Angels and Builders / >

For investors:

A 3,000-word deep dive on how to get that sweet sweet deal flow 🤌🏼

signatureblock.co/articles/how-t…

— Ryan Hoover (@rrhoover)

2:34 PM • Apr 7, 2023

These days I get emails not only from early stage startups but also from...other VCs.

In fact, I get about 2-3 fund managers *per week* asking for LP intros as they get ready for their next fundraise...

I get it - I've been there. So how to solve for this?

More >>

— Elizabeth Yin 💛 (@dunkhippo33)

4:15 PM • Apr 7, 2023

I've reviewed 10+ YC applications in the last 24 hours.

Here are the 3 biggest pieces of advice I give to these founders:

— Neil Thanedar (@NeilThanedar)

2:02 PM • Apr 5, 2023

Get in losers, we're starting an accelerator!

a16z, Variant, Delphi, Paradigm have all launched accelerators/fellowships this year

What gives?

-Higher aum-->more expensive alpha

-YC reputation decline

-Hunt for lower cost basis1/ Some jumbled thoughts on this trend

— Regan Bozman (@reganbozman)

9:13 PM • Apr 6, 2023

Meme-led Growth: How Humor And Creativity Can Help Your Business Stand Out by @anilbms75 for Startup Stash blog.startupstash.com/meme-led-growt…#meme#humor#startupgrowth

— Startup Stash (@startupstash)

5:30 AM • Mar 28, 2023

Fundraising Journey Q&A

< Sharing insights & takeaways from the fundraising process / >

Reply to this email or reach out to [email protected] if you or a founder you know would like to be spotlighted in our weekly 1-on-1 founder Q&A - sharing insights from their fundraising journey (free marketing 😁)

Sign up for Beta Access

Sign up for the Drawbridge Data Beta Database today 👇

(now say it 5 times fast!)