- The Data Room

- Posts

- The Data Room #1

The Data Room #1

Fundraising Data + Market Intelligence for Investors & Startups

Why We’re Launching This?

The Data Room is the flagship newsletter of Drawbridge Data — a venture intelligence platform, fundraising launchpad and investor CRM rolled into one platform with one mission — connecting startups & investors at every stage of the relationship

This newsletter is the initial gateway to our community as we build out the MVP. We want to provide a quick hitting data-driven recap of the startup fundraising landscape, showcase the week’s top charts & data, share 1-on-1 insights from a newly seeded founder’s and curate all the must read blogs and articles of the week in one place — The Data Room

By launching the Drawbridge platform, we aim to supercharge founders on the fundraising journey while democratizing deal flow and streamlining the investment processes for investors of all sizes from sourcing to closing the deal and beyond.

We would love to hear continued feedback from the community as we grow. Please reply to this or reach out anytime if you’d like to learn more about Drawbridge Data and our platform in development or if you're a newly funded founder who would like to be spotlighted in the Founder Journey Q&A section of this newsletter (free marketing!)

- 👷♂️ Drawbridge Team

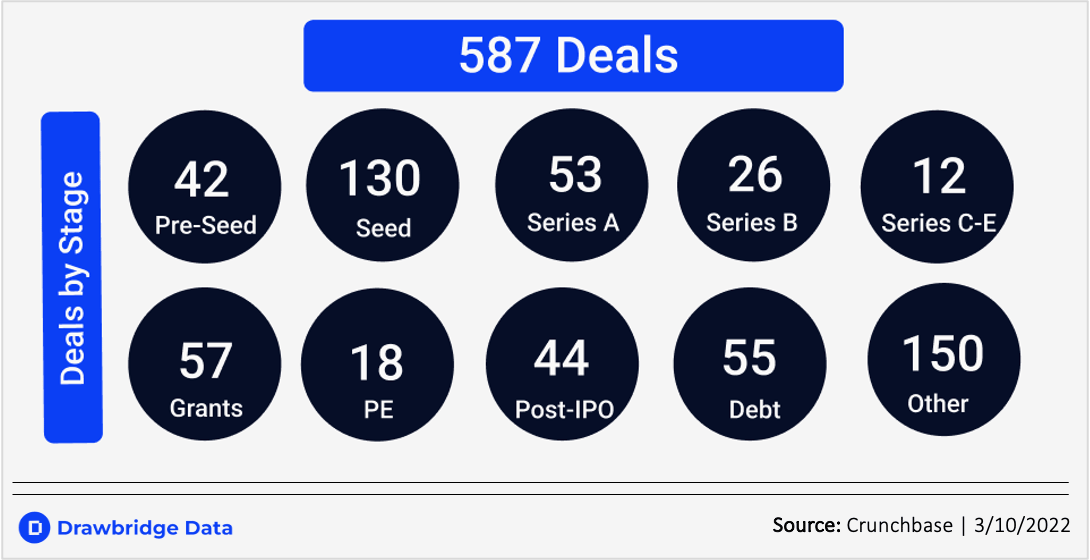

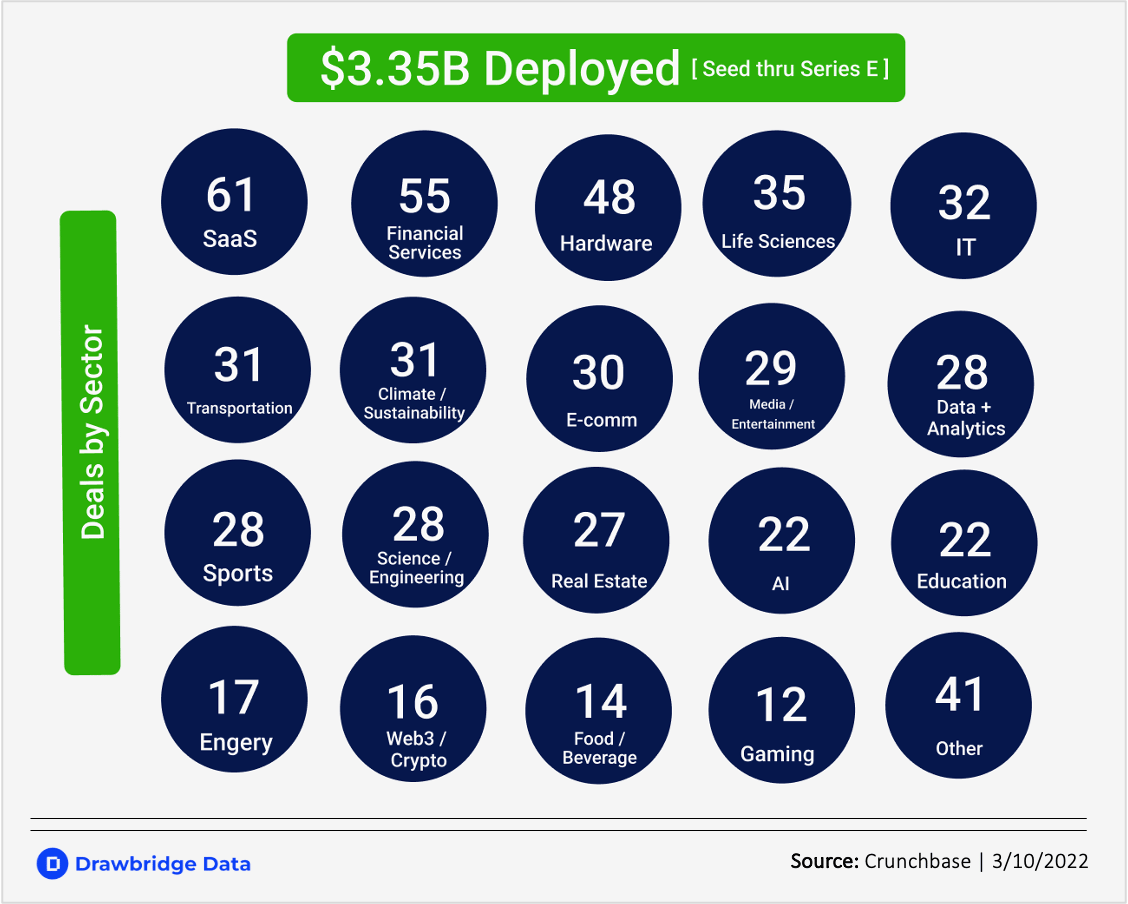

Weekly Fundraising Overview

< Sector specific weekly fundraising overview / >

[ Data from Week of March 3 - March 9 ]

The Mad Dash

< Curated charts that filter the noise to tell the real story / >

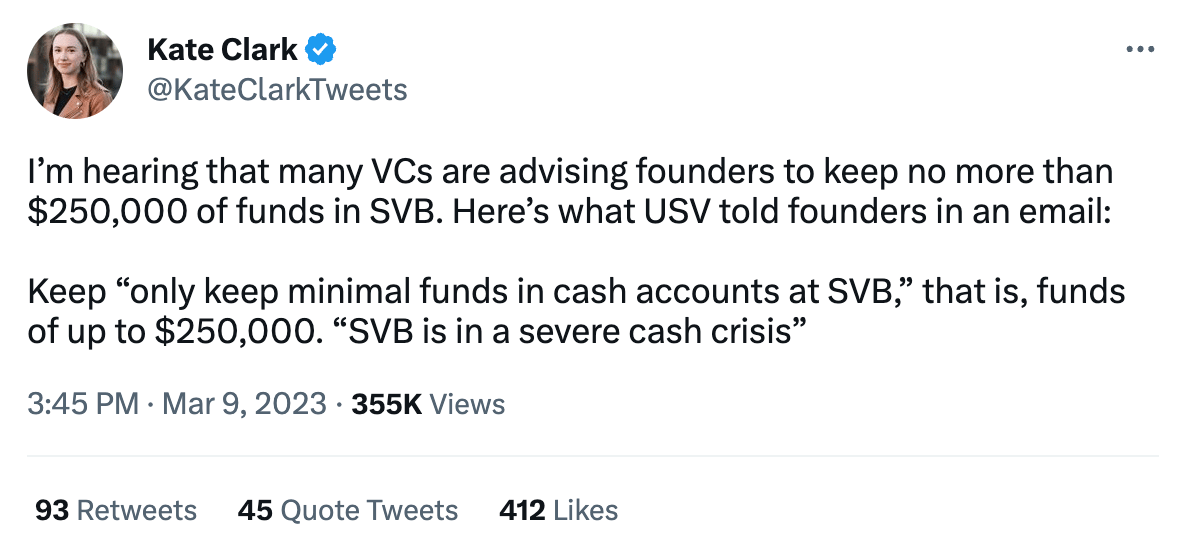

SVB stock cratered 60% during Thursday’s trading hours and another 22% after hours as the popular bank for startups and investors in Silicon Valley fights insolvency rumors. The CEO has told VC clients to '“stay calm” amid Peter Thiel’s calls for companies to withdraw funds.

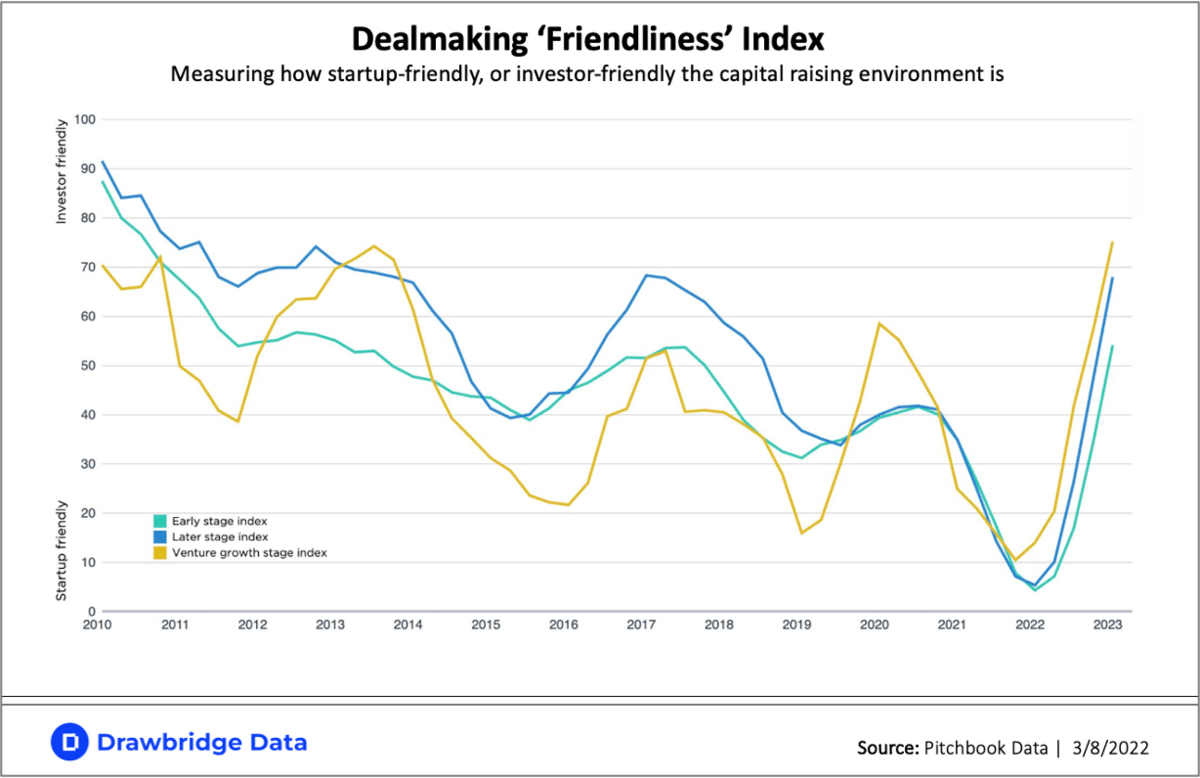

This chart tells a dozen different stories as public offerings of VC/PE backed companies in 2022 cratered to a 14 yr low. Many late stage investors were left holding the bag as valuations plummeted alongside volume

This one speaks for itself - the frothy fundraising environment in 2021 has (over)corrected to the mean over the last 12 months.

Source: Crunchbase | 3/9/2023

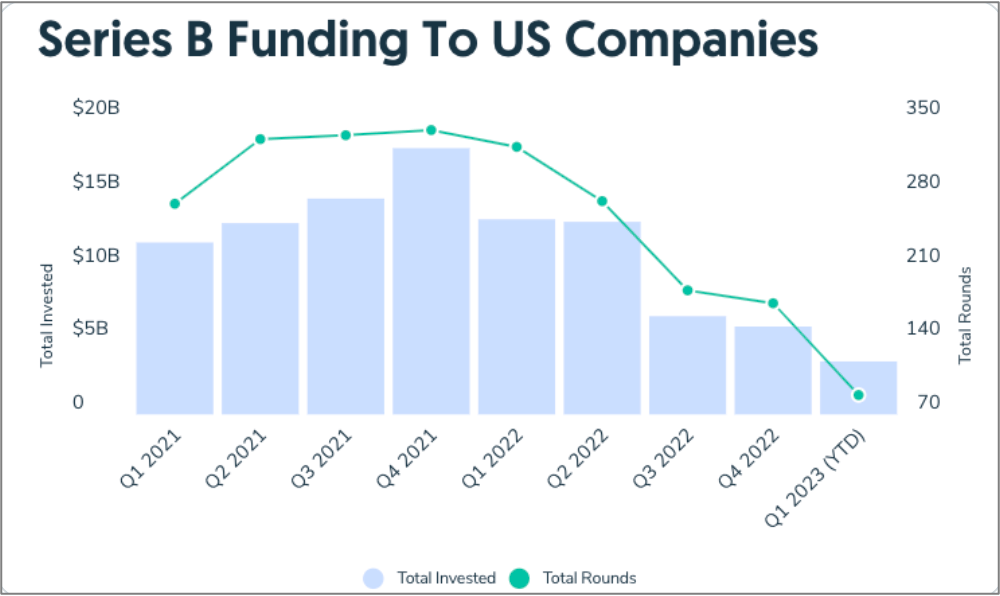

Series B investments continue to fall, on track to come in at the lowest quarterly level in more than three years. In addition, Series B investments in the second half of 2022 were down over 60% from the same period in 2021. Start-ups are hard to scale, let alone with the headwinds of a macro downturn

@mfriedrichARK | Twitter

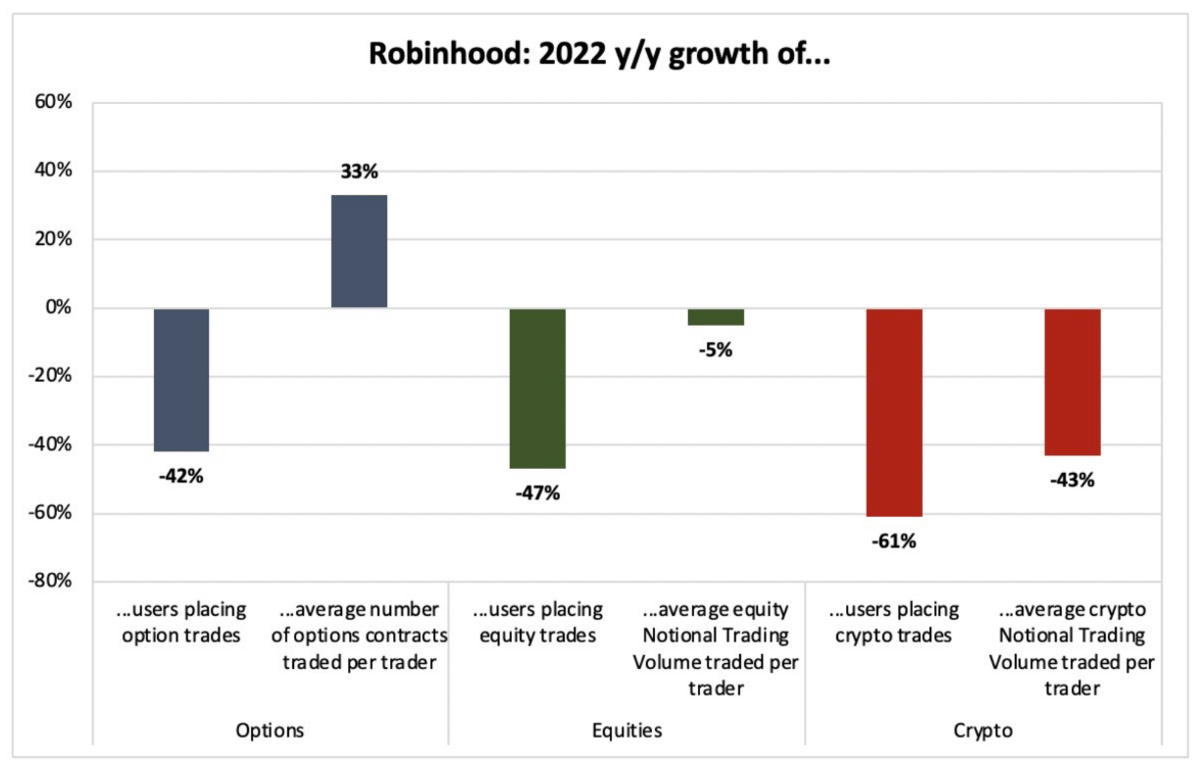

According to their recent 10-K, Robinhood’s y/y growth has cratered with Crypto unsurprisingly leading the route. Despite this, HOOD is up just under 16% YTD

Must Reads of the Week

< Top reads from the week in fundraising, startups and venture capital / >

[Bloomberg] SVB Chief Sold $3.6 Million in Stock Days Before Bank’s Failure

[Hari Raghavan] SVB Crisis Playbook for Founders

[Elizabeth Yin Blog] How I raised my $11.5m VC fund

[Elad Gil Blog] Don’t Ask For Too Much Money

[CNBC] Rise of ‘Zombie’ VCs Haunts Tech Investors as Plunging Valuations Hammer the Industry

[Business Insider] Half of Sequoia Capital's VC funds since 2018 have posted losses for the University of California's endowment [LP data shows]

[Chris Neumann Blog] The Dark Side of VC Recycling

[CoinGecko] How Much Did Each Crypto Sector Raise [since 2018]

[Elad Gil Blog] Startup Decoupling & Reckoning

Fundraising Journey Q&A

< Sharing insights & takeaways from the fundraising process / >

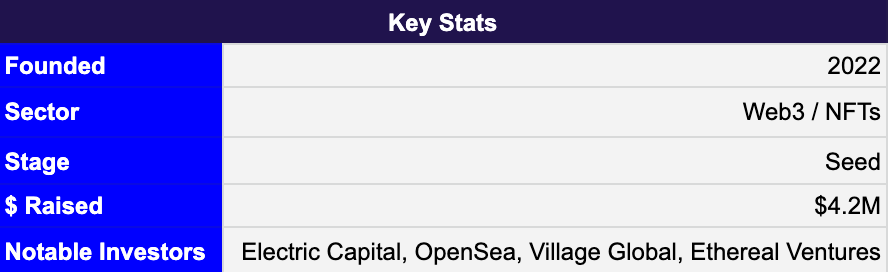

Nathaniel Naddaff-Hafrey, Co-founder @ Lasso Labs

Links: Website | Twitter | LinkedIn | Press Release

What was your biggest learning from the fundraising process?

Reinforcing our belief that a fundraising process should be run with the same operating rigor and emphasis on storytelling that you’d expect from any well-oiled GTM motion. This extends to building and diversifying your “pipeline,” forecasting likelihood-to-close, managing conversations over multiple stages of the funnel, and so on. An IRL human connection makes a difference. You need to break the video call monotony that both sides are experiencing.

What tools or resources were most helpful during the process?

We didn’t use anything special. Our fundraising “stack” was basically just Google Meet, Docsend, Figma (for our deck), and an investor CRM and forecasting model that we built in Google Sheets. We wrote a standard FAQ and diligence (Google) doc. Comms were over email, Twitter, or Telegram. Some investors wanted to fund via USDC, which was fast and easy using a Gnosis Safe and a Circle account.

What would you do differently during the process, if anything?

I am spiritually allergic to slide decks. In retrospect, though, we ended up relying heavily on several versions of a deck, and could have saved ourselves some cycles by building the right “content room” earlier in the process. Within the deck, we’d focus more on mocks, prototypes, etc, than conceptual or explanatory content. It can be hard to do so, because you present to so many different types of investors, with varying levels of context. In an ideal world, you have multiple versions of the deck that you use depending on the audience.

What was the most stressful part of the process?

Balancing fundraising with actually building the company: talking to users, working on product, building a hiring pipeline, etc. You read the news and see peers getting funded, or you get into a loop of nonstop emails, calls, and follow-ups. It’s easy to feel like you’re not moving fast enough, or that your process is more complicated than others. In most cases, it’s not.

What tools or resources could have streamlined the process or made it easier for both parties?

I don’t think tools are the issue when it comes to fundraising. If anything, a reliance on raising-at-a-distance, mediated by video calls and Docsend, has made the process a lot more impersonal. Yes, it’s great that you can stack multiple meetings in a day, without travel expenses; this is particularly good for founders who would otherwise have trouble accessing venture capital. For me, as a founder in the Bay Area, I would much rather run an in-person process, and get a chance to properly assess potential partners IRL.

What do you wish you knew about the process before diving in?

I wish I had known that Terra/Luna was going to implode while we were out raising… This wasn’t my first time fundraising, but it was my first in the crypto/web3 market. It was a less formal and structured process, relative to others I’ve run in the past, with a lot of the introductions happening on Twitter/Telegram. The dynamics reminded me more of my experience launching a business in Southeast Asia, where almost everything seems to happen on Whatsapp. Having appropriate expectations for how/where fundraising will be conducted informs the type of materials that are needed.

What is your biggest piece of advice for 1st time founders?

There are times when fundraising is the absolute most important thing for your company, but it can’t be the only thing that you do or you’ll lose your edge, energy, and sense of perspective. Make sure that you stay connected to the product and business you’re trying to run, as it will help you reset from the ups & downs of the fundraising process.

And, of course, it’s important to ensure that you have the right level of balance in terms of exercise, sleep, etc, so that you can maintain your judgment and genuine excitement for what you’re doing. You are evaluating investors as much as they’re evaluating you, and should be selective in picking your partners. Trust your gut: if you don’t feel like a partner or a firm is a good fit, or the process is lagging for some reason, don’t be afraid to move on and spend your time elsewhere. Operate with a baseline mentality of strength and conviction.

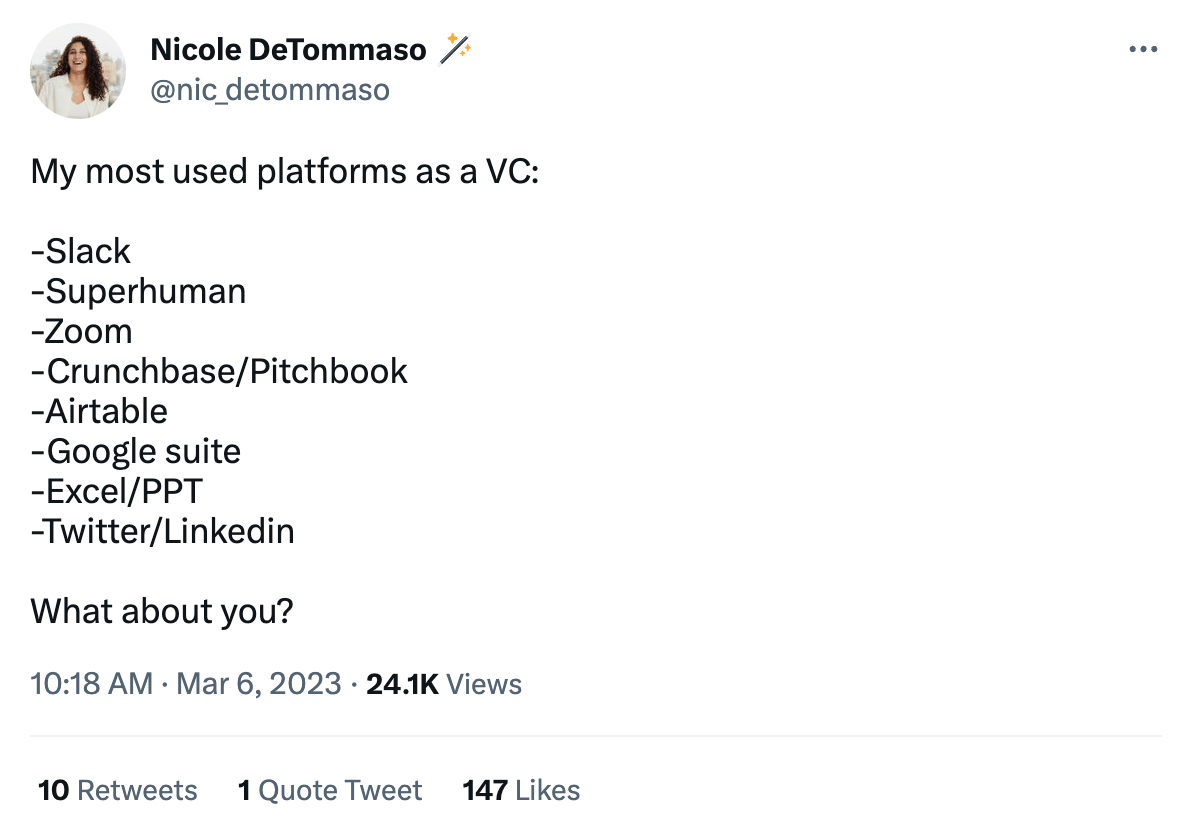

Cant Miss Tweets

< Must See tweets from VCs, Angels and Builders / >

Sign up for Beta Access

Don’t be a Beta — sign up for the Drawbridge Data Beta Database today 👇

(now say it 5 times fast!)